Brief

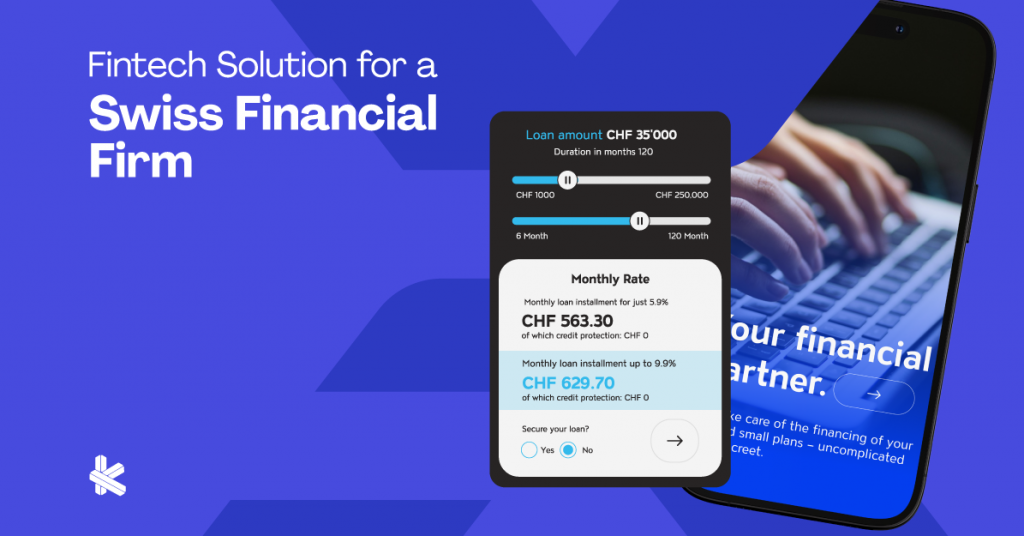

Our client is a leading financial firm in Switzerland offering a wide range of financial services, private loans, mortgage and installment insurance to individuals. With a reputation for reliability and customer-centricity, the client aimed to modernize its loan application platform to streamline processes and maintain competitiveness in the digital era.

The Challenges

The current path to progress had some obstacles.

- Usability Challenges: The existing platform had a complex user interface, leading to a high bounce rate and incomplete applications.

- Scalability Issues: As the client expanded its customer base, the existing platform struggled to handle increased traffic and application volumes efficiently.

- Compliance Concerns: Regulatory changes required the integration of new features to ensure compliance with Swiss financial regulations, including data privacy and anti-money laundering laws.

Solution

Through a collaborative effort involving user research, compliance expertise, and agile development practices, we successfully redesigned the loan application platform. The new platform not only improved user experience and efficiency but also ensured compliance with regulatory requirements, positioning our client for continued success in the competitive financial services industry.

- Improved User Experience: Enhanced the platform’s usability and accessibility to increase application completion rates.

- Increased Scalability: Redesigned the platform infrastructure to support a growing user base and increased application volumes.

- Ensured Regulatory Compliance: Integrated necessary features to meet Swiss financial regulations without compromising user experience or efficiency.

Key Features Implemented

- Simplified Application Process: Redesigned the application forms and user interface to streamline the process and reduce friction for users.

- High Security Measures: Enhanced security protocols to safeguard sensitive user data and ensure compliance with data protection regulations.

Outcome

- Improved User Experience: The redesigned platform witnessed a significant increase in user satisfaction, reflected in higher completion rates and reduced bounce rates.

- Increased Efficiency: Automation of verification processes led to faster application processing times, reducing the burden on administrative staff and improving overall efficiency.

- Regulatory Compliance: The platform now fully complies with Swiss financial regulations, providing users with peace of mind regarding data privacy and security.

- Scalability: The upgraded infrastructure proved to be highly scalable, accommodating a growing user base and ensuring consistent performance even during periods of high demand.